What are the maximum contributions for your pillar 3a in 2024?

Maximum retirement benefits and maximum tax savings? We show you everything you need to know about the maximum pillar 3a amount.

Maximum retirement benefits and maximum tax savings? We show you everything you need to know about the maximum pillar 3a amount.

Employees with a pension fund (2nd pillar)

can pay a maximum of CHF 7056 into their pillar 3a.

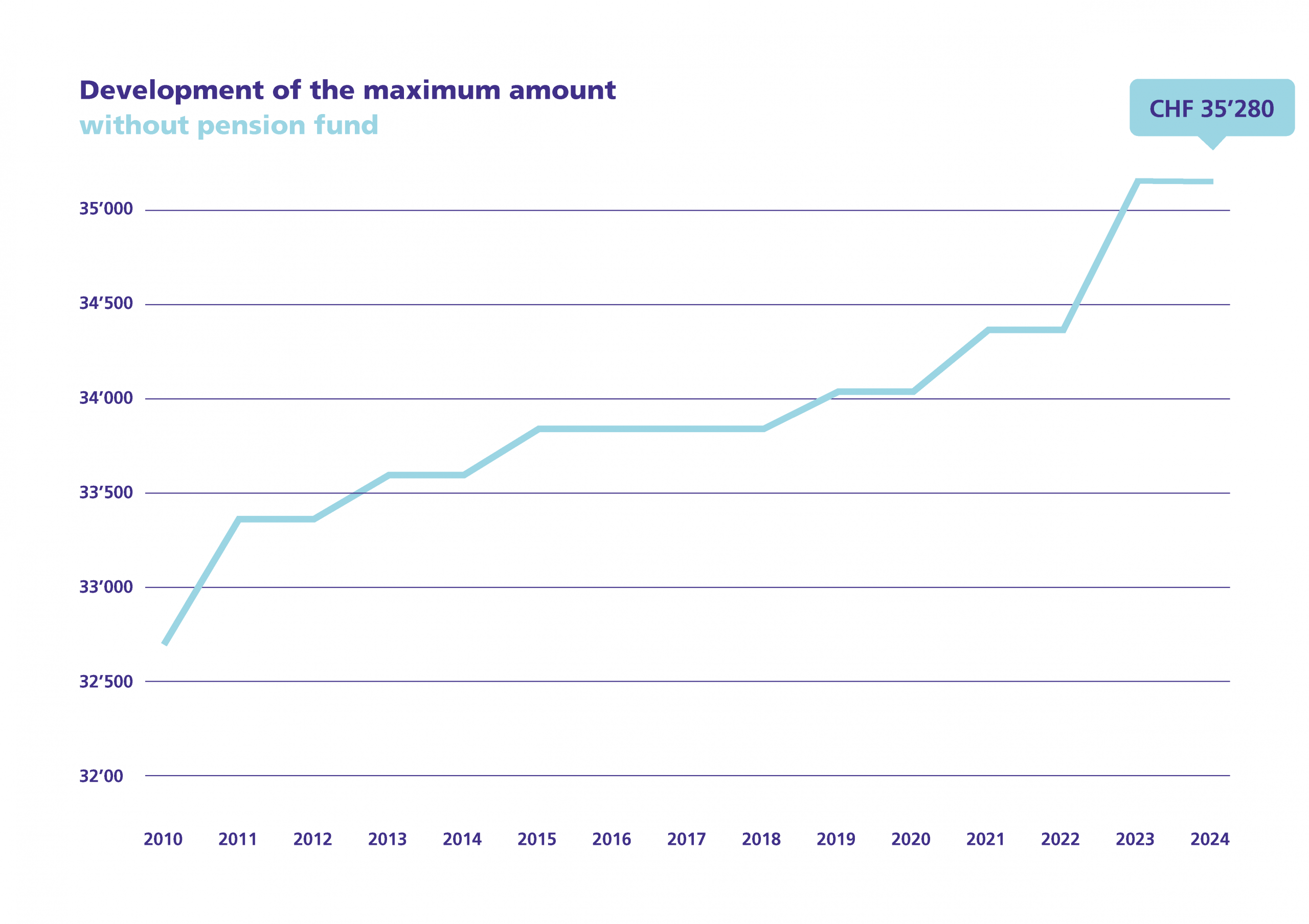

Self-employed persons without a pension fund (2nd pillar)

can pay 20% of their net earned income into their pillar 3a up to a maximum of CHF 35280.

1. If you pay the maximum amount into your pillar 3a each year, you will be excellently prepared for your old age.

2. By paying in the maximum amount you will achieve the maximum tax savings. You can find out more about saving on taxes here.

The maximum amount for the pillar 3a (“tied pension provision”) is set annually by the Federal Social Insurance Office. The amount is taken from the maximum stipulated by the BVG, the Federal Law on Occupational Old Age, Survivors’ and Disability Pension Plans.

Every two years, the Federal Council reviews any adjustment to pensions, and with it also the maximum AHV pension.

The BVG maximum corresponds to three times the maximum AHV pension for the current year. According to BVV 3, employees with a pension fund may pay 8% of the BVG maximum into their pillar 3a and self-employed persons without a pension fund may pay 40%. |

Maximum AHV pension in 2024:

CHF 29'400.–

BVG maximum in 2024:

3 x CHF 29'400.– = CHF 88'200.–

Maximum contribution for employed persons with a pension fund:

CHF 88'200.– x 8 % = CHF 7056.–

Maximum contribution for employed persons without a pension fund:

CHF 88'200.– x 40 % = CHF 35280.–

How does a pension gap arise and why should you pay the maximum contribution into your pillar 3a if possible?

Persons of retirement age can continue to pay into the scheme until five years after reaching the normal retirement age, provided they are still in employment. The current retirement age is 64 for women and 65 for men. From 2025, the reference age for women will be increased in stages. From 2028, the same reference age of 65 will apply for women and men.

Despite a temporary interruption in gainful employment, the pillar 3a deduction entitlement is maintained as soon as a replacement income or income from gainful employment subject to AHV contributions is received (e.g. military service, maternity, etc.).

You can’t pay the maximum contribution into your pillar 3a this year? Don’t worry, deposits can be made from as little as CHF 1. Here we show you why a pillar 3a is also worthwhile if you don’t have much money to spare.

CHF 100* voucher for the transfer of your pillar 3a to frankly >

Please rotate device