Save on taxes with frankly

Save for retirement and save on taxes - twice the benefits.

Find out with the help of our five examples, and secure the best possible provision for your dreams with frankly pillar 3a.

Find out with the help of our five examples, and secure the best possible provision for your dreams with frankly pillar 3a.

Regardless of whether you are just starting out in your career, self-employed, employed full-time or part-time, retirement provision always plays a central role. With our five examples, we’ll help you find out what you should be paying attention to right now and how you can best set up your pillar 3a according to your needs.

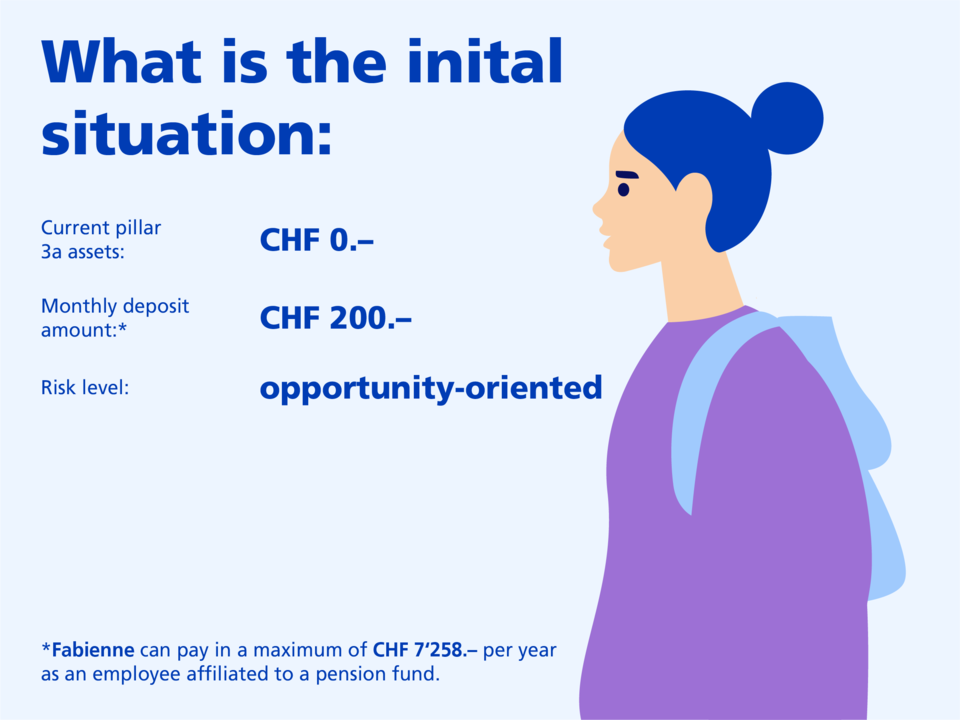

Let's assume you are Fabienne, 25 years old, and you’ve started your first job as a graphic designer after finishing your degree. You’re single with no children. Your retirement date is still 40 years away, but you are aware of the importance of retirement planning. To keep the pension gap as small as possible you would be best advised to start now, even if you don’t have so much money available to save.

Possible investment product: Extreme 95 Responsible

Fabienne opts for a sustainable, active investment product. Due to her long investment horizon and her pronounced risk appetite, she opts for a very high equity component (95%). The objectives of the investment product are to achieve long-term capital gains and to generate income. Fabienne is prepared to accept considerable price fluctuations in the process. Thanks to her long-term investment, securities offer her the prospect of higher return opportunities than a pillar 3a bank account, where interest rates are likely to remain very low for a long time.

What kind of pension could Fabienne achieve with frankly by the time she retires?

Based on the initial situation, Fabienne could achieve the following retirement savings with frankly compared to a traditional pillar 3a banking product.

Statement of changes in net assets

If Fabienne were to leave her money in a normal 3a account, in 40 years’ time, assuming interest rates remain low at 0.25%, she would have CHF 101,084. If she were to save in securities, however, with a hypothetical return of 4.76% (net after costs) this could rise to CHF 230,000. The possible savings with securities are worth much more than just a few hundred francs. Fabienne, for example, is 25 years old and in employment. She pays CHF 2,400 into her pillar 3a account with frankly each year until her expected pension age of 65, and she chooses an investment product with an equity component of 95%.

Calculation and risk information

Assumptions: equity component 95%, hypothetical return per year 4.76% (net after costs). The future returns and risks presented here are for illustrative purposes only. Securities savings may fluctuate, the hypothetical return cannot be guaranteed, and tax effects are not included in this forecast.

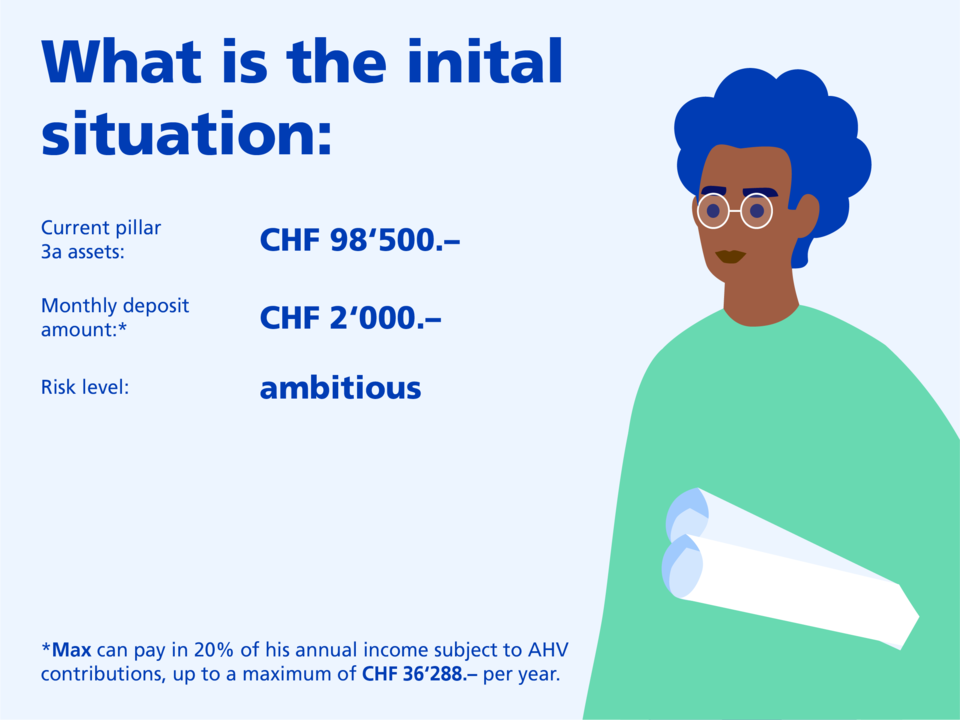

Max is 35 years old and single. He works as an architect in Zurich-Wollishofen and is not a member of a pension fund. He has another 30 years until retirement. That’s a long way off, which means that it’s all the more important for him to make the right decisions now.

Possible investment product: Strong 75 Responsible

Max opts for a sustainable, active investment product that contains a high equity component (75%). The objectives of the investment product are to achieve long-term capital growth and to generate income. In exchange, Max is willing to take a higher risk. Active investment products are also designed to “beat the market”, i.e. to achieve a better investment performance than the market average.

What kind of pension could Max achieve with frankly by the time he retires?

Based on the initial situation, Max could achieve the following retirement savings with frankly compared to a traditional pillar 3a banking product.

Statement of changes in net assets:

If Max were to leave his money in a normal 3a account, in 30 years’ time, assuming interest rates remain low at 0.25%, he would have CHF 854,748. However, if he were to save in securities with a 75% equity component, with a hypothetical return of 4.06% this could rise to CHF 1,563,400. The possible savings with securities are worth much more than just a few hundred francs. Max, for example, is 35 years old, self-employed and not a member of a pension fund. In the future he pays CHF 24,000 each year into his pillar 3a account with frankly, and he chooses an investment product with an equity component of 75%. He transfers an additional CHF 98,500 from his previous pillar 3a over to frankly.

Calculation and risk information

Assumptions: equity component 75%, hypothetical return per year 4.06% (net after costs). The future returns and risks presented here are for illustrative purposes only. Securities savings may fluctuate, the hypothetical return cannot be guaranteed, and tax effects are not included in this forecast.

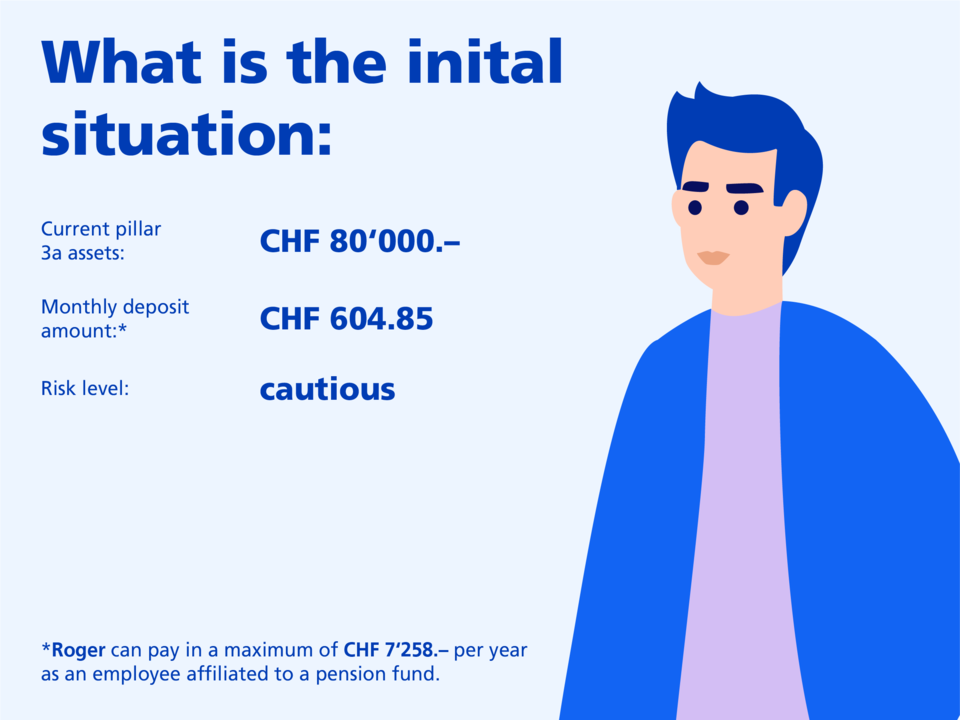

Let's assume you are Roger, 40 years old, and you work in a managerial position at a government administration in Lausanne. You’re married and you’ve just had your first child. You don’t retire for another 25 years, and your big dream is to buy an apartment in just over five years. You don’t have enough capital though, and you want to use your 3rd pillar to cover the cost.

Possible investment product: Gentle 25 Index

Roger would like to use his pillar 3a assets to buy property. This can be done. Pillar 3a assets can be used to finance the purchase of owner-occupied residential property or to renovate/convert the home or to repay a mortgage on it.

The selected investment product with a low equity component of 25% pursues the objective of mirroring the development of the market as closely as possible and, if possible, achieving moderate long-term investment gains.

What kind of savings could Roger achieve with frankly in five years?

Based on the initial situation, Roger could achieve the following savings with frankly in five years’ time compared to a traditional pillar 3a banking product:

Statement of changes in net assets

If Roger were to leave his money in his original normal 3a account, in five years’ time and assuming interest rates remain low at 0.25% he would have CHF 117,568. If he were to save in securities, however, with a hypothetical return of 2.06% (net after costs) this could rise to CHF 126,460.

The possible savings with securities are worth much more than just a few hundred francs. Roger, for example, is 40 years old and in employment. He pays the maximum amount of CHF 7,258 each year into his pillar 3a account with frankly for five years, and he selects an investment product with an equity component of 25%. He transfers an additional CHF 80,000 from his former pillar 3a over to frankly.

Calculation and risk information

Assumptions: equity component 25%, hypothetical return per year 2.06% (net after costs). The future returns and risks presented here are for illustrative purposes only. Securities savings may fluctuate, the hypothetical return cannot be guaranteed, and tax effects are not included in this forecast.

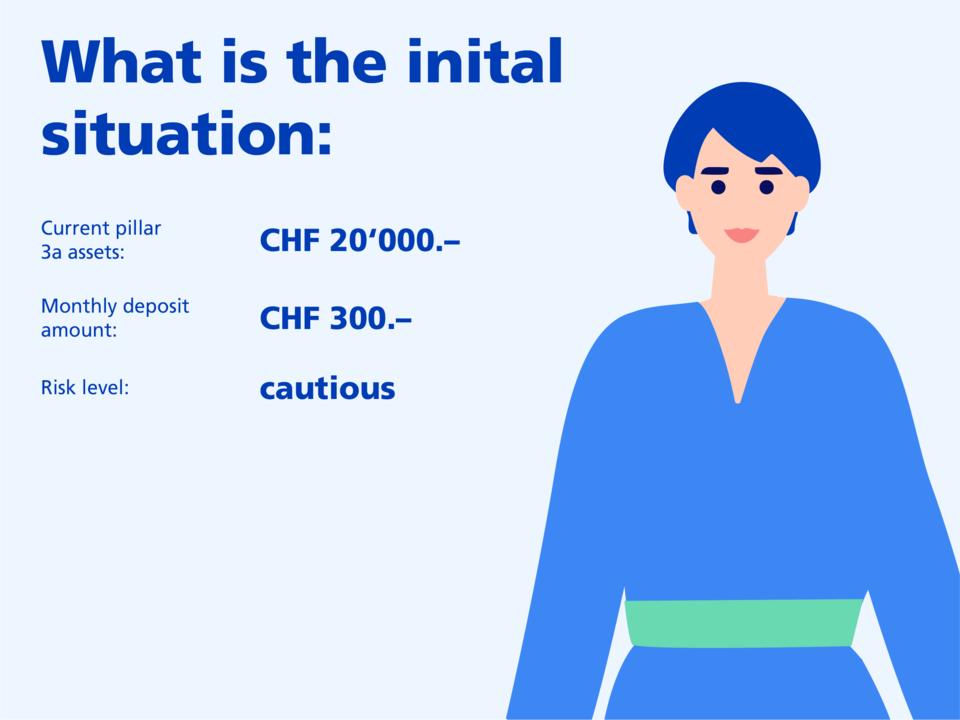

Let’s assume you are Alice, 50 years old, work part-time on a 0.2 FTE basis at a controlling company in Berne and you are not a member of a pension fund.

You are married, and have a 15-year-old daughter and a 12-year-old son. What’s important to you is that you make a sustainable contribution to society with your investments. You have another 15 years until retirement. That’s a long way off, which means that it’s all the more important for you to make the right decisions now.

Mögliches Anlageprodukt: Gentle 25 Responsible

Part-time workers are particularly at risk of losing their old-age pension. Part-time employees with such a low salary cannot join a pension fund. They are allowed to transfer 20% of their earned income to the 3rd pillar. This makes it all the more important for Alice to lay the foundations for her future and fill up her 3rd pillar as much as possible.

She opts for a sustainable, active investment product with a low equity component (26%) and a higher bond component (59%). The focus is more on security and manageable risks. Alice can accept minor fluctuations in assets because of her long investment horizon (15 years until retirement). Active investment products are also designed to “beat the market”, i.e. to achieve a better investment performance than the market average.

What kind of pension could Alice achieve with frankly by the time she retires?

Based on the initial situation, Alice could achieve the following retirement savings with frankly compared to a traditional pillar 3a banking product:

Statement of changes in net assets

If Alice were to leave her money in her original normal 3a account, in 15 years’ time and assuming interest rates remain low at 0.25%, she would have CHF 75,856. If she were to save in securities, however, with a hypothetical return of 2.06% (net after costs) this could rise to CHF 89,700.

Calculation and risk information

Assumptions: equity component 26%, hypothetical return per year 2.06% (net after costs).The future returns and risks presented here are for illustrative purposes only. Securities savings may fluctuate, the hypothetical return cannot be guaranteed, and tax effects are not included in this forecast.

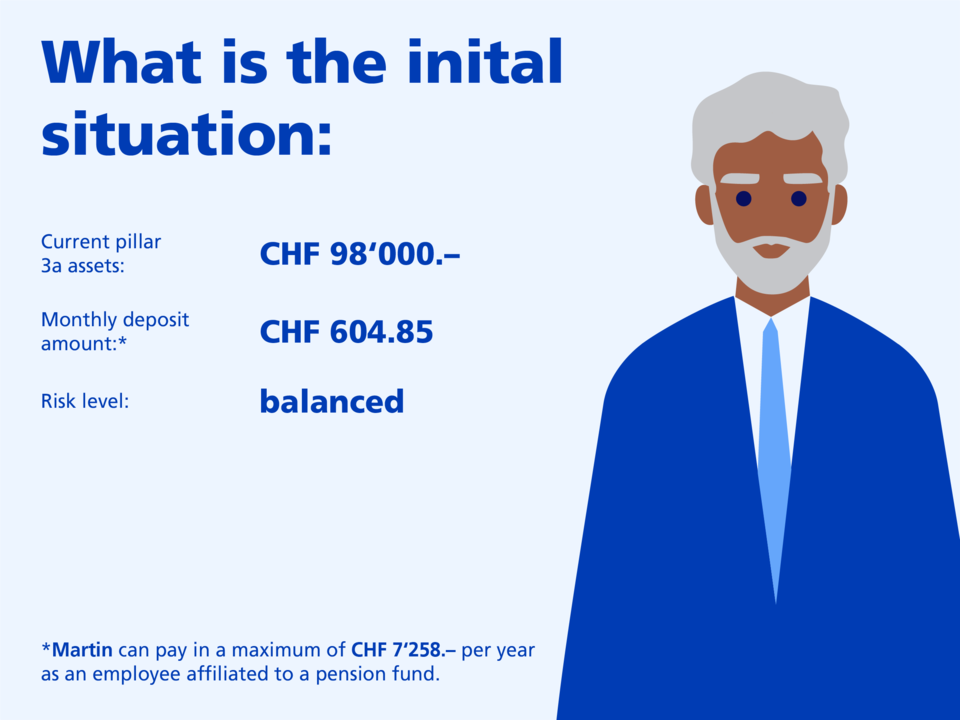

Let’s assume you are Martin, 55 years old, and you work as a sales representative for a chemical company in Basel. You’re married with two grown-up children. Your retirement date is only 10 years away. Getting a good return on your investment products in the 3rd pillar and paying as little as possible in fees is important to you. You have a busy life and don’t want to spend a lot of time getting your 3rd pillar just right.

Possible investment product: Moderate 45 Responsible

Martin opts for a sustainable, active investment product that contains a medium equity component (45%). The objectives of the investment product are to achieve long-term capital gains and to generate income. On the other hand, Martin is risk tolerant without taking major risks, since his investment product also consists of 40% bonds and 15% real estate.

Active investment products are also designed to “beat the market”, i.e. to achieve a better investment performance than the market average.

What kind of pension could Martin achieve with frankly by the time he retires?

Based on the initial situation, Martin could achieve the following retirement savings with frankly compared to a traditional pillar 3a banking product:

Statement of changes in net assets

If Martin were to leave his money in his original normal 3a account, in 10 years’ time and assuming interest rates remain low at 0.25%, he would have CHF 174,063. If he were to save in securities, however, with a hypothetical return of 3.06% (net after costs) this could rise to CHF 214,500.

The possible savings with securities are worth much more than just a few hundred francs. Martin, for example, is 55 years old and in employment. In future, he pays the maximum amount of CHF 7,258 each year into his pillar 3a account with frankly, and he selects an investment product with an equity component of 45%. He transfers an additional CHF 98,000 from his previous pillar 3a over to frankly.

Calculation and risk information

Assumptions: equity component 45%, hypothetical return per year 3.06% (net after costs). The future returns and risks presented here are for illustrative purposes only. Securities savings may fluctuate, the hypothetical return cannot be guaranteed, and tax effects are not included in this forecast.

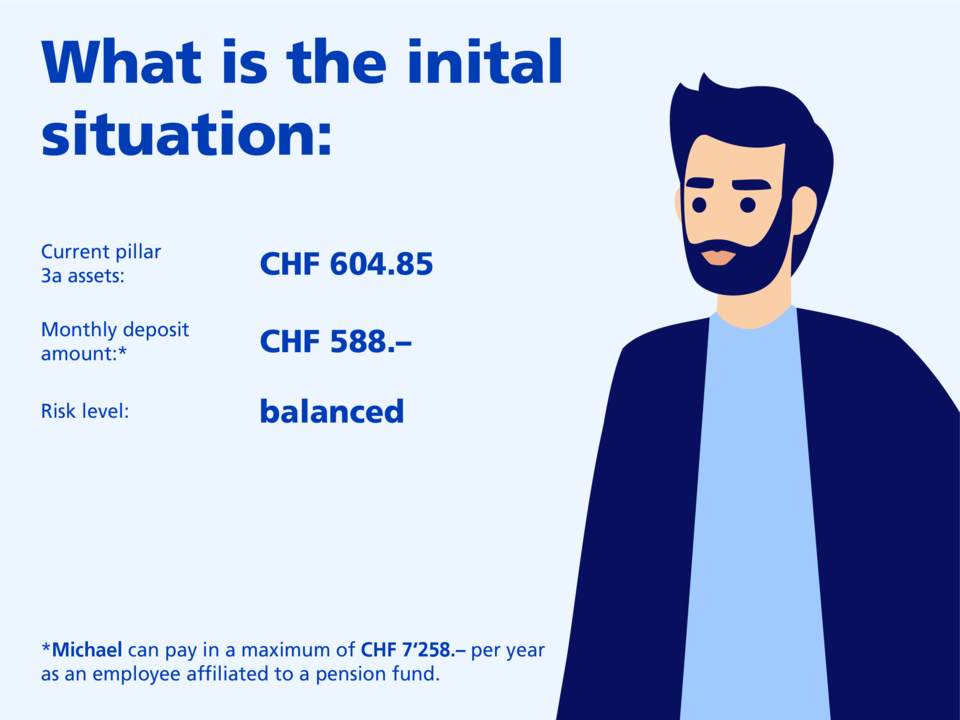

Let’s say you are Michael, you’ve recently moved to Switzerland and you are employed: Michael is 45 years old and married. He works as an IT specialist in Zurich Enge and is a member of a pension fund. He has another 20 years until retirement age. That’s a long way off, which means that it’s all the more important for him to make the right decisions now.

Possible investment product: Moderate 45 Index

Michael opts for an indexed investment product that contains a moderate equity component (45%). The investment product aims to generate long-term capital gains in the form of price increases and income from dividends and interest payments. In exchange for this, Michael is willing to take a risk. Indexed investment products are also designed to track the performance of the market as closely as possible and to generate moderate investment gains over the long term.

What kind of savings could Michael achieve with frankly?

Based on the initial situation, Michael could achieve the following retirement savings with frankly compared to a traditional pillar 3a account:

Statement of changes in net assets

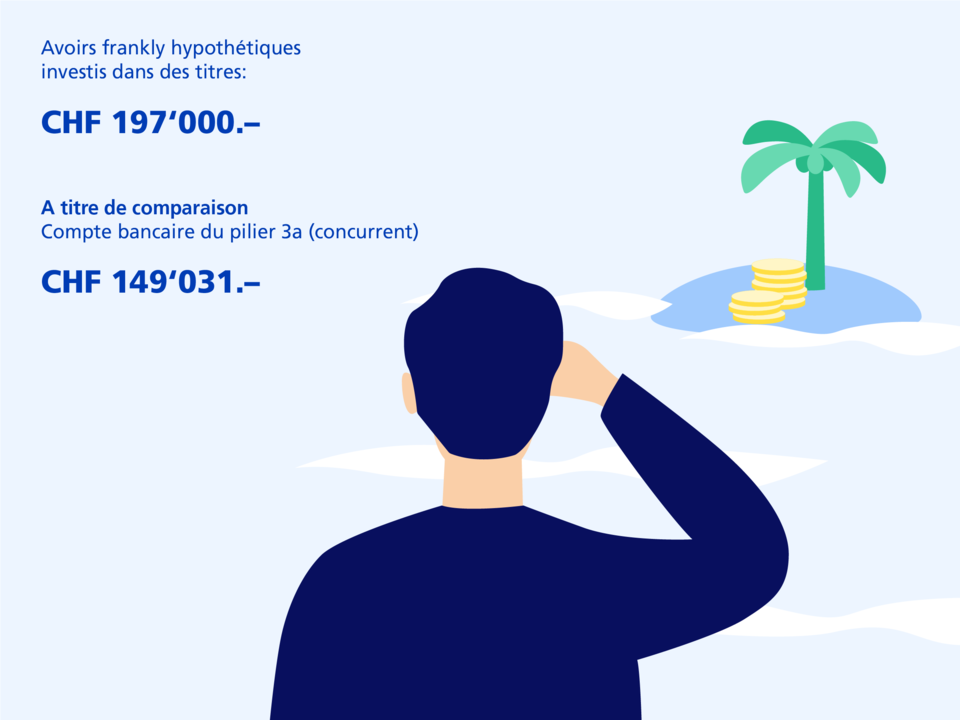

If Michael were to leave his money in a normal 3a account, in 20 years’ time, providing he remains employed and living in Switzerland and assuming interest rates remain low at 0.25%, he would have CHF 149,031. However, if he were to save in securities with a 45% equity component, with a hypothetical return of 3.06% (net after costs) this could rise to CHF 197,000.

The possible savings with securities are worth much more than just a few hundred francs. Michael, for example, is 45 years old, employed and a member of a pension fund. In the future he pays CHF 7,258 each year into his pillar 3a account with frankly, and he chooses an investment product with an equity component of 45%.

Calculation and risk information

Assumptions: equity component 45%, hypothetical return per year 3.06% (net after costs).The future returns and risks presented here are for illustrative purposes only. Securities savings may fluctuate, the hypothetical return cannot be guaranteed, and tax effects are not included in this forecast.

General calculation and risk information

Economic models and statistical methods are used for calculation purposes. The forecast corresponds with the most likely performance, and can be predicted for an investment horizon of up to 10 years. In the event of a longer investment horizon the calculations are continued using the same values, whereby no statements can be made about the probability of the calculated results occurring. In the event of very unfavourable market developments, the performance may be lower than the nominal savings value. The calculated values are net of the frankly all-in fee, and are based on an interest rate on the pillar 3 account of 0.25%. Please note that inflation and the taxes payable when the balance becomes due are not included in this forecast.