The pillar 3a calculator

Calculate your potential 3a assets with or without securities. Find out how you can get more out of your pillar 3a.

Even though retirement planning may not interest you as much when you’re young, it’s important to start thinking about it as early as possible.

How to get started with your pillar 3a.

The pillar 3a is relevant to you right from the age of 18 when you start earning your first salary, and you should start to set aside a small portion for your pension from then onwards. After all, time is your friend – even small contributions have a big impact over long periods of time, especially with securities savings.

The pension assets could also become useful to you sooner than you think, for example if you want to start your own business or dream of owning your own home. By the way, you also save on taxes right from the start!

You can set up an account with as little as CHF 1. It’s not just the amount you pay in that matters, the important thing is that you are investing in your 3rd pillar at all. Remember that even small amounts can multiply over a long period of time.

We recommend that you plan your budget. This will show you how much you have left over for your pension at the end of the month. You can adjust the amount you pay in at any time depending on your life situation.

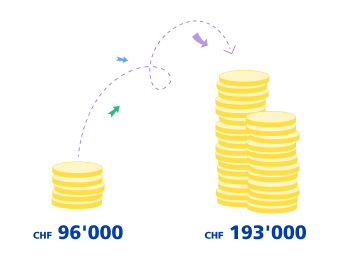

The example of Jonas and Leon shows the effect you can achieve with a longer savings horizon alone.

His theoretical capital at retirement age is equivalent to CHF 193,000.

His theoretical capital at retirement age is equivalent to CHF 160,400.

.r200img.svg/1748958919207/zkb-content-frueh-vorsorgen-%281%29.svg)

Both have paid the same total amount into their pillar 3a. Nevertheless, Jonas has higher potential returns thanks to the longer savings horizon, and therefore has CHF 32,600 more at his disposal than Leon when he retires.

Equity component 45%, hypothetical return per year 3.36% (net after costs). The future returns and risks presented here are for illustrative purposes only. Securities savings may fluctuate, the hypothetical return cannot be guaranteed, and tax effects are not included in this forecast.