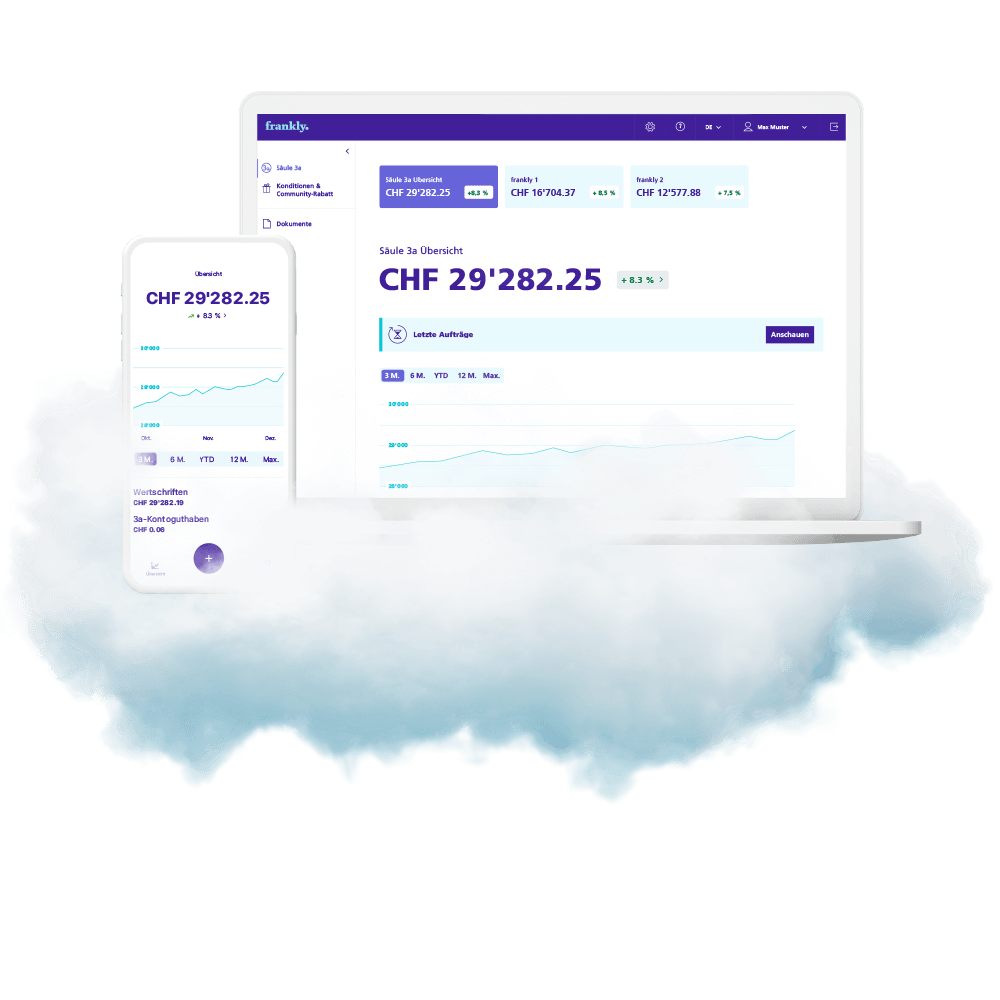

Säule 3a geht ganz leicht.

Starte heute mit frankly und wähle deine Säule 3a Cash mit Vorzugszins oder investiere in die mehrfach ausgezeichneten Swisscanto Anlageprodukte. Eröffnung in nur wenigen Minuten, alles digital.

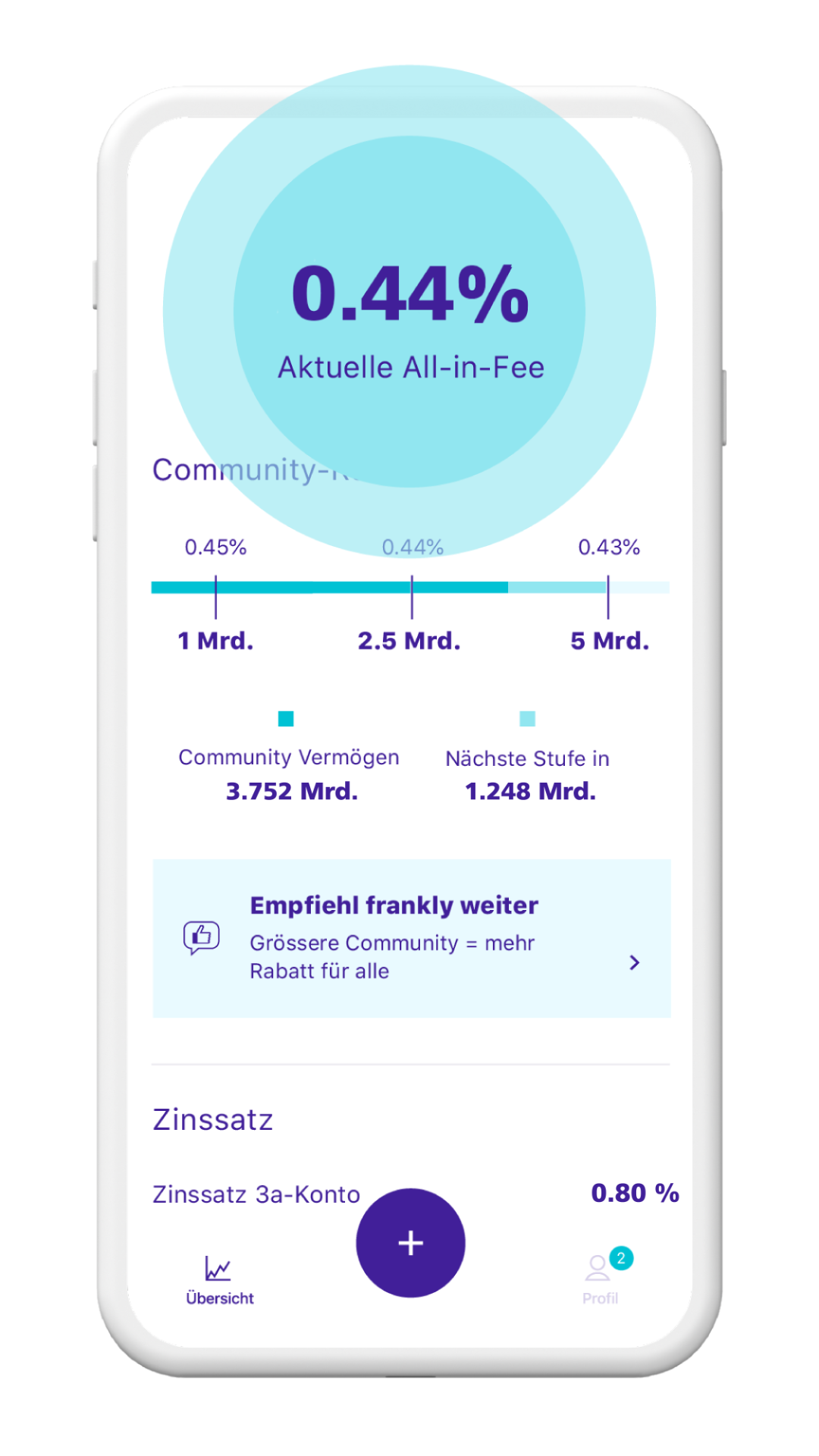

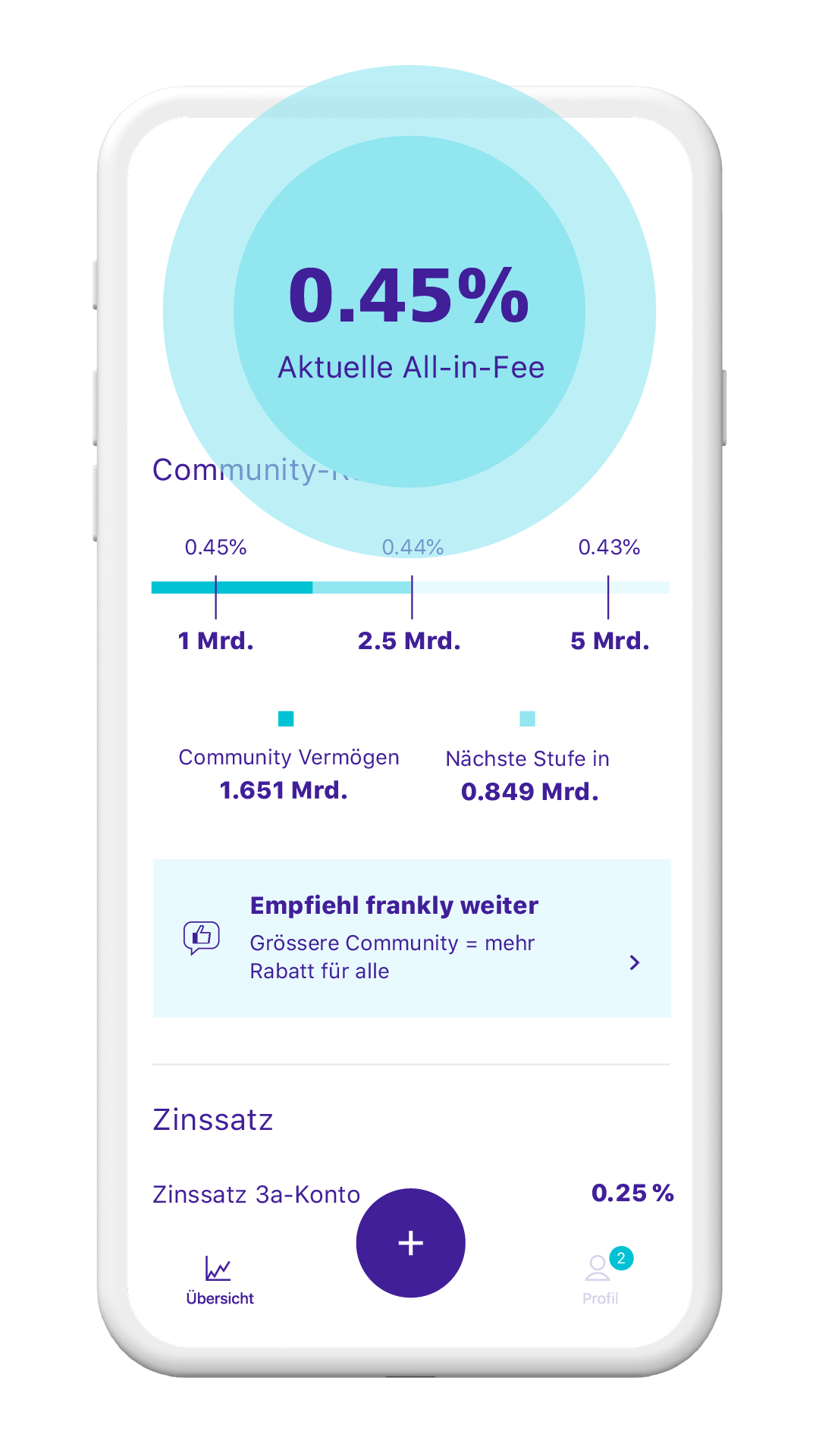

Wer im Zeitraum vom 01.05. und dem 30.06.2024 die meisten erfolgreichen Empfehlungen macht, hat die Chance, CHF 1'000.–, ein iPhone 14 Pro, ein iPad oder andere attraktive Preise zu gewinnen.