Säule 3a geht ganz leicht.

Aktion:

Bis zum 30. April 2024 die bestehende Säule 3a zu frankly wechseln und von einem CHF 100.- Gebührengutschein* profitieren. Dies gilt bei einem Übertrag von mind. CHF 7'500.-.

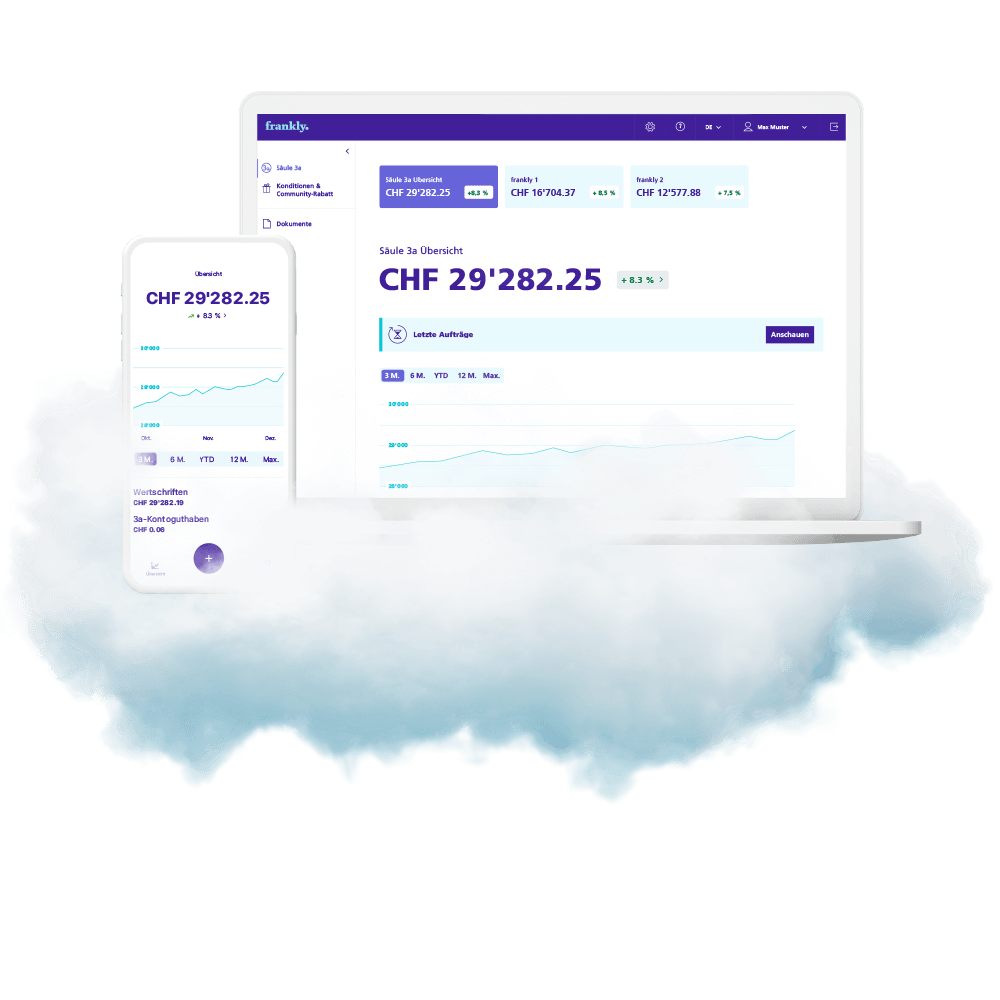

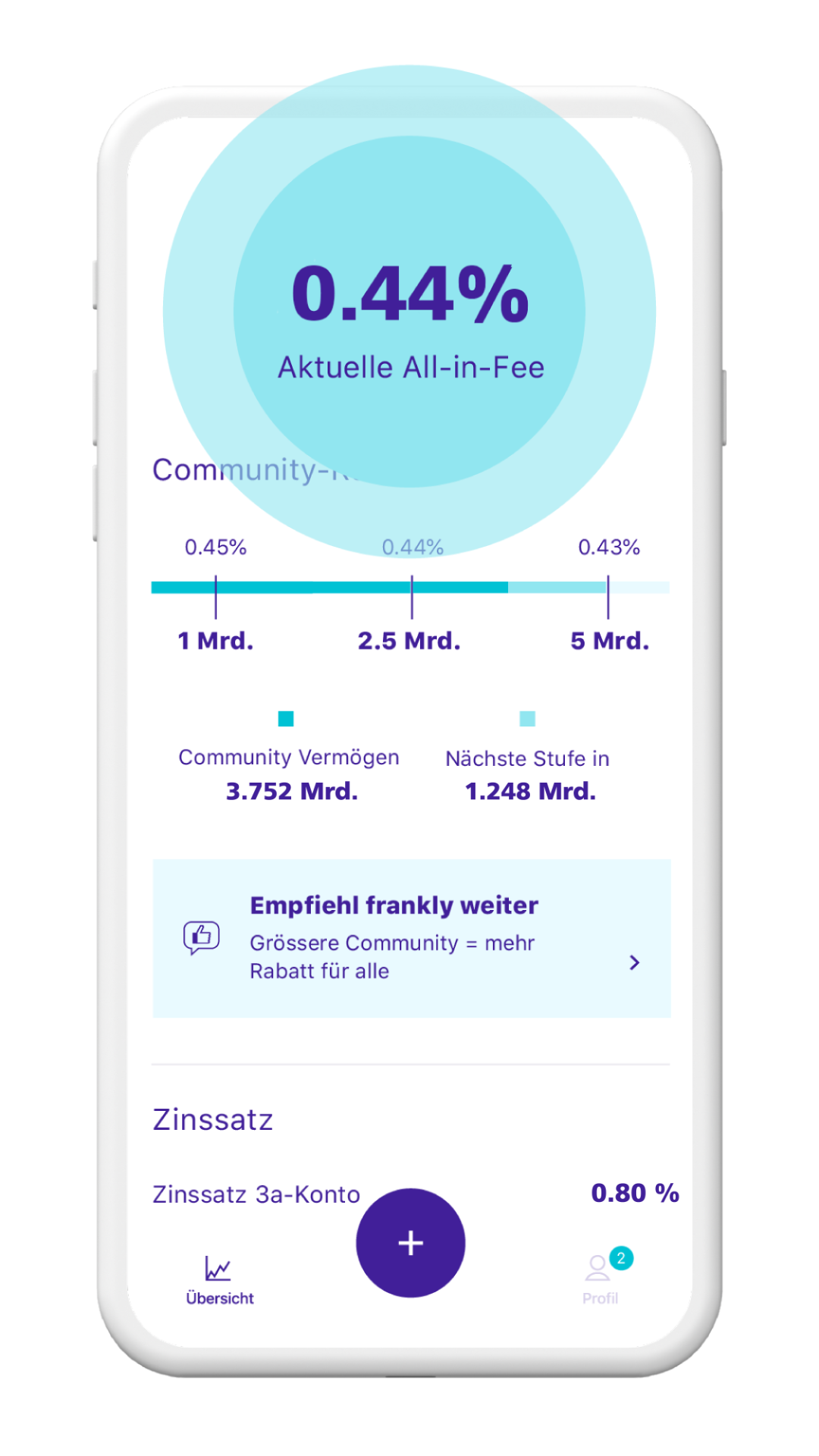

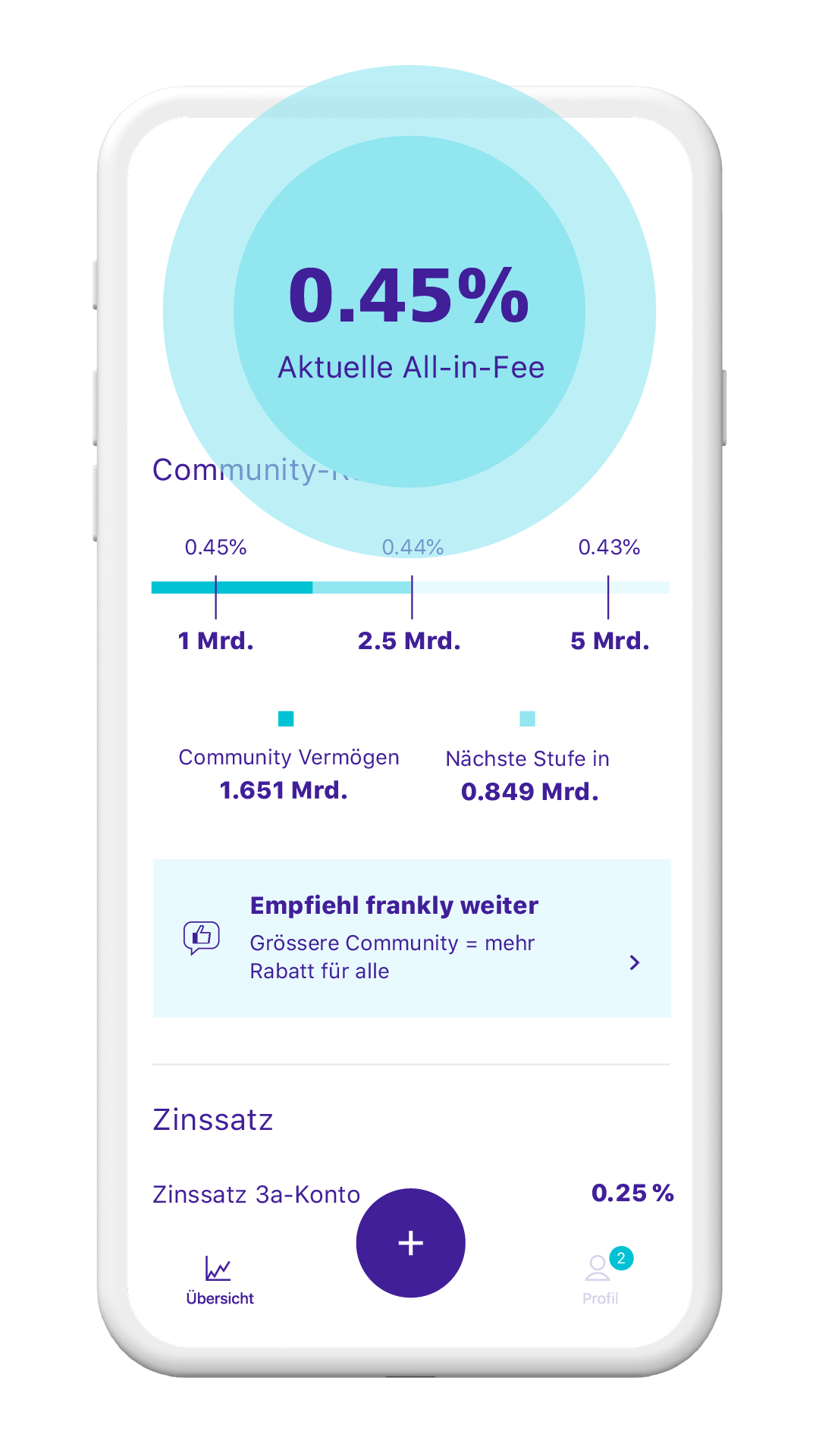

Starte heute mit frankly und wähle deine Säule 3a Cash mit Vorzugszins oder investiere in die mehrfach ausgezeichneten Swisscanto Anlageprodukte. Eröffnung in nur wenigen Minuten, alles digital.

Entwickelt von der Zürcher Kantonalbank, eine der sichersten Universalbanken der Welt. Auch als Web-Version.