Säule 3a geht ganz leicht.

Starte heute mit frankly und wähle deine Säule 3a Cash mit Vorzugszins oder investiere in die mehrfach ausgezeichneten Swisscanto Anlageprodukte. Eröffnung in nur wenigen Minuten, alles digital.

Starte heute mit frankly und wähle deine Säule 3a Cash mit Vorzugszins oder investiere in die mehrfach ausgezeichneten Swisscanto Anlageprodukte. Eröffnung in nur wenigen Minuten, alles digital.

Alles digital. Eröffnung in wenigen Minuten. Ohne Papierkram und ohne Bankbesuch.

Investiere in hochwertige Swisscanto-Anlageprodukte oder spare mit Vorzugszins im Cash.

59% günstiger als verglichene Angebote des Wertschriftensparens (Quelle: moneyland.ch).

Aktive Anlageprodukte von Swisscanto mit Nachhaltigkeitsansatz «Responsible» oder «Sustainable».

Dein mögliches 3a Vermögen frankly:

Berechnungs- und Risikohinweise

Jede Anlagestrategie hat eine eigene Prognose. Für die Berechnung werden ökonomische Modelle und statistische Methoden verwendet. Dabei wird zwischen einer erwarteten Wertentwicklung, dem unteren Wert (sehr schlechte Entwicklung) und dem oberen Wert (sehr gute Entwicklung) unterschieden. In 95 von 100 Fällen sollte die Wertentwicklung deines Guthabens zwischen dem oberen und dem unteren Wert liegen. Die Prognose kann für einen Anlagehorizont von maximal 10 Jahren erstellt werden. Bei einem längeren Anlagehorizont werden die Berechnungen mit den gleichen Werten fortgeführt, wobei keine Aussagen über die Wahrscheinlichkeit möglich sind, dass die berechneten Ergebnisse eintreten werden. Die berechneten Werte verstehen sich netto unter Abzug der frankly All-in-Fee und basieren auf einer Verzinsung von 0.80% auf dem Säule 3a Konto. Bitte beachte, dass die Inflation und die bei Fälligkeit des Guthabens anfallenden Steuern in dieser Prognose nicht mit eingerechnet sind. (Stand 01.01.2024)

Die All-in-Fee auf deinem Wertschriftenguthaben beträgt dank des Community-Rabattes aktuell nur 0.44%. Bei frankly erwarten dich keine Gebühren für die Wertschriftenverwahrung und keine pauschalen Verwaltungskommissionen des Anlageproduktes – sie sind in der All-in-Fee enthalten.

Wertschriftensparen mit frankly ist halb so teuer wie mit verglichenen Angeboten (Quelle: moneyland.ch). Bitte beachte, dass bei den indexierten Anlageprodukten insbesondere Ausgabe- und Rücknahmespesen zugunsten des Fonds anfallen, die nicht in der All-in-Fee enthalten sind. Eine genaue Definition der All-in-Fee findest du in den FAQ.

Auf deinem frankly Cash fällt keine All-in-Fee an.

Vorsorge leicht gemacht. Du brauchst nur dein Smartphone, Tablet oder Computer und einen Ausweis. Natürlich helfen wir dir bei jedem Schritt. Jetzt registrieren und los geht's. In wenigen Minuten bist du dabei. Worauf wartest du noch?

Das oberste Ziel liegt darin, dein Vermögen aufzubauen. Die ausgezeichneten Anlageprodukte unserer Partnerin Swisscanto unterstützen sowohl vorsichtige als auch mutige Anlagestrategien.

Ganz egal, ob du in Sachen Wertschriften ein Neuling oder ein Experte bist: Entscheide selber, ob dir frankly ein Anlageprodukt passend zu deinen Bedürfnissen vorschlagen soll oder ob du dich als Experte gleich direkt für ein Anlageprodukt entscheidest.

Du möchtest auf Nummer Sicher gehen. Dann lege dein Geld in Cash ohne Risiko an.

Unsere Swisscanto Anlageprodukte nehmen eine Vorreiterrolle bei nachhaltigen Anlagen ein. Investiere in die aktiv gemanagten, nachhaltigen Swisscanto-Anlageprodukte zu einer All-in-Fee von derzeit nur 0.44%. Das gibt es nur bei frankly.

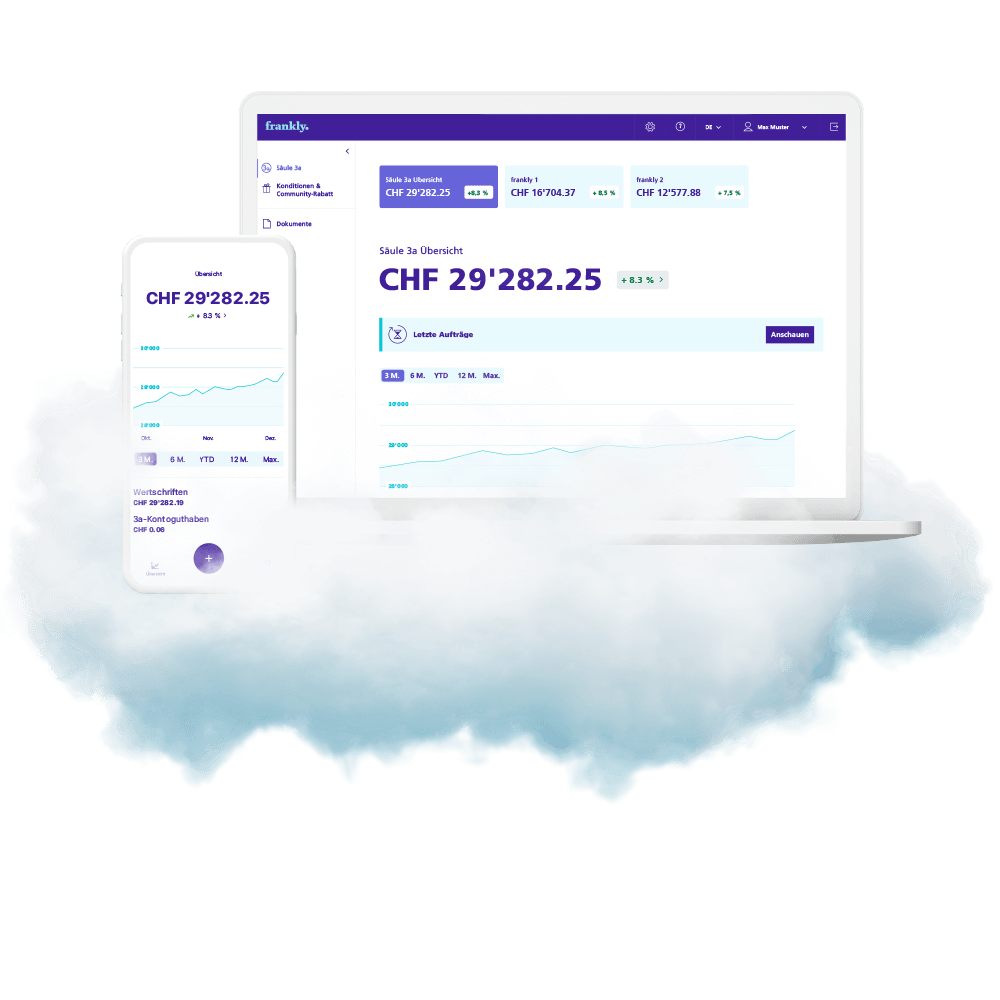

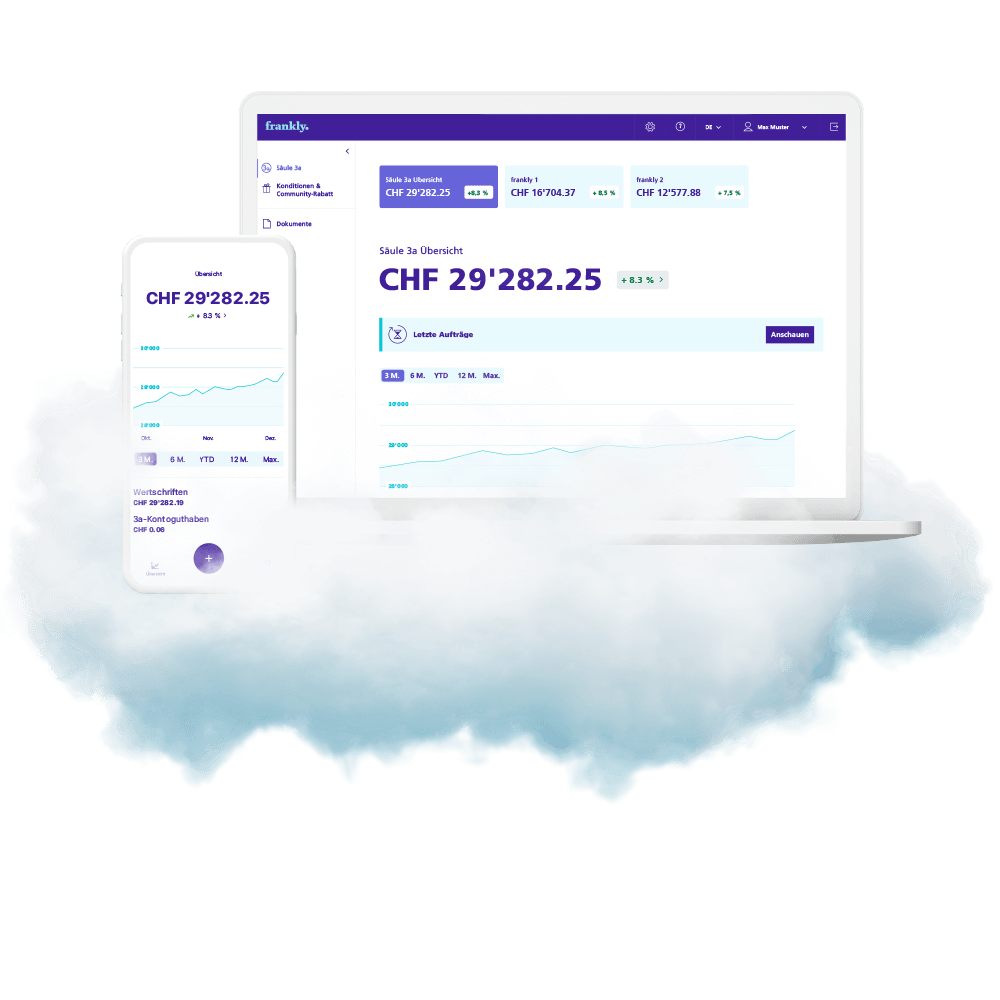

Du möchtest jederzeit den vollen Durchblick bei deiner Altersvorsorge haben? Mit frankly weisst du jederzeit, wie sich dein Vermögen entwickelt, kannst einzahlen und hast Zugriff auf deine Anlage-Strategie. Egal wo du bist.

frankly jetzt herunterladen oder sofort online registrieren.

Einfach Säule 3a eröffnen – ganz ohne Papierkram, alles digital.

Vorsorgeguthaben auf frankly einzahlen.

Heute mit frankly starten und in mehrfach ausgezeichnete Anlageprodukte von Swisscanto investieren. Digital, transparent und sicher.

CHF 35.-* Gutschein + Gewinnchance auf CHF 1'000.- >

Bitte Gerät drehen