Splitting your pension fund: stagger withdrawals and save on taxes Splitting your pension fund

Split your assets when leaving your pension fund: how to be more flexible when cashing out. Find out more!

Find out how you can split your assets and save on taxes when leaving your pension fund.

What is pension fund splitting?

When you leave your pension fund, you can split your pension assets across two vested benefits foundations. This is what’s known as pension fund splitting. The assets will remain in the two vested benefits foundations until you transfer them to a new pension fund or they are paid out to you for reasons permitted by law. These reasons include, for example, when you reach retirement age or when you withdraw the funds to purchase an owner-occupied residential property.

Who is splitting suitable for?

Splitting is suitable for anybody who is leaving a pension fund and joining a new one within the foreseeable future.

Possible reasons for splitting your assets include:

- Early termination of employment

- Becoming self-employed without withdrawing your vested benefits

How are payouts from your pension fund taxed?

When you withdraw your assets from your pension fund or your vested benefits foundation, a one-off capital gains tax payment becomes due. This is calculated separately from your regular income and also taxed at a lower rate. Different tax rates apply depending on which canton you live in. Your marital status and religion also have an impact on which tax rate you pay..

Tax calculator

Do you want to know how much tax you would have to pay when withdrawing your pension fund assets? You can work this out with the tax calculator.

Save on taxes by withdrawing capital in stages

If you have split your pension fund assets across two vested benefits foundations, you can withdraw them over different tax periods. This way, you can save on taxes similarly to making a staggered withdrawal of your Pillar 3a assets. This is because capital gains tax is progressive, meaning that you pay more in taxes both in absolute terms and in percentage terms the more money you withdraw. This often happens when you only have one (i.e. not split) vested benefits account, because it is not permitted to make partial withdrawals.

Important: Plan the staggered withdrawal of your assets at an early stage. Consider that withdrawals from the pension fund (2nd pillar and Pillar 3a can be added together in the same year – even for married couples. There may be differences between different cantons.

Example calculation: how splitting works

For our example, let’s take a single person resident in the city of Zurich, non-confessional, with vested benefits of CHF 500,000. With only one vested benefits account, if he/she withdrew his/her funds he/she would pay taxes of around CHF 35,800. However, if he/she split her funds between two vested benefits foundations with CHF 250,000 held in each one, he/she could withdraw them over different years. Then he/she would only pay around CHF 29,500 in taxes overall. Thanks to splitting and staggering his/her withdrawals, he/she therefore saved around CHF 6,300 in taxes.

How do I go about splitting assets?

There are different ways in which you can split your assets across two vested benefits foundations. It may make sense to split them as follows:

50/50 split

50/50 split

The assets are evenly split into two halves.

Mandatory/extra-mandatory component

Mandatory/extra-mandatory component

The assets are split between the mandatory (BVG) component and the extra-mandatory (BVG-ÜO) component.

Rounded split

Rounded split

Part of the assets are rounded (e.g. CHF 300,000) and the remainder (e.g. CHF 150,567) is transferred to the other foundation. Splitting your assets like this may make sense, for example if you intend to become self-employed but don’t need all your assets to do this.

Unequal split in the event of very high amounts of vested benefits

Unequal split in the event of very high amounts of vested benefits

It may make sense to make an unequal split if you already come under the highest tax band. You should consult a tax expert to work out what the best split is in your particular situation.

Equal end value

Equal end value

The split is based on the expected returns, meaning that you get roughly the same amounts afterwards. This strategy can make sense, for example if you hold a cash account with a foundation but want to invest in securities with the other foundation.

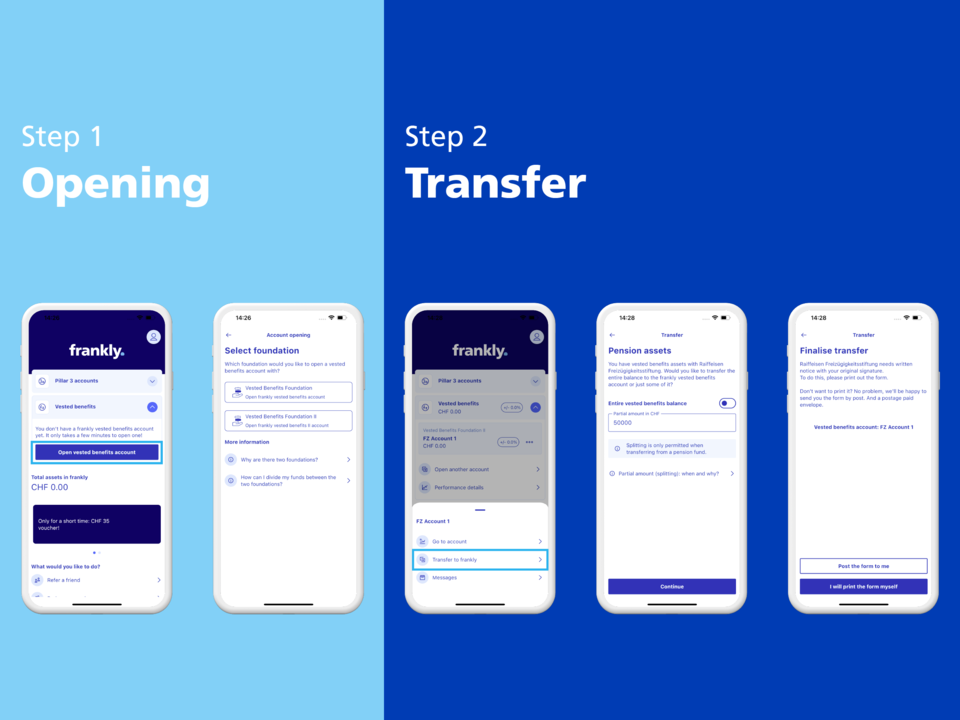

Splitting with frankly: step by step

We will show you step by step how easy splitting your assets is with frankly.

- Open two vested benefits accounts with frankly:

Sign up with frankly and set up two accounts: one with the Vested Benefits Foundation and the other with the Vested Benefits Foundation II. - Split assets:

Set up a transfer order for each vested benefits account directly in the frankly app or web version, and enter the partial amount that you want to transfer from your pension fund. For example, you can split your assets into two halves or into the mandatory and extra-mandatory components. You are best advised to find out in advance what kinds of split are allowed by your pension fund. Once you have decided, send the signed transfer order to your previous pension fund. Then we’ll do the rest for you. - Wait for further notice:

It may take several weeks for your pension fund to transfer your funds to frankly. But don’t worry, frankly will tell you straight away as soon as it has received your money. - Manage your assets online:

Conveniently manage your assets online via the frankly app or the web version.

Why does frankly have two vested benefits foundations?

Why does frankly have two vested benefits foundations?

With frankly you can split your vested benefits between two vested benefits foundations belonging to Zürcher Kantonalbank – the Vested Benefits Foundation and the Vested Benefits Foundation II. The two foundations are necessary, because the vested benefits cannot be transferred to two accounts with the same vested benefits foundation when leaving a pension fund.

Vested benefits account or custody account?

A vested benefits account enables you to invest your money at a preferential interest rate. By contrast, a vested benefits custody account offers the opportunity to invest your pension capital in securities to potentially generate a higher income. Which option is most suitable for you depends on your individual circumstances and goals.

Benefits of splitting

- Save on taxes

By splitting you can withdraw your assets in your old age spread over multiple tax years and usually pay less in taxes. - Flexible withdrawals

By splitting you don’t have to withdraw everything all at once when you only need part of your money. - Safeguard your assets

Both frankly vested benefits foundations offer identical conditions and a very high level of security, since your funds held in account form are deposited with Zürcher Kantonalbank.

Frequently asked questions

Can I split my assets at a later stage?

Can I split my assets at a later stage?

No, you may only split your vested benefits as aone-off when leaving your pension fund. As soon as the money has been placed with a vested benefits foundation it can no longer be divided. Partial withdrawals are also only permitted in a few cases, such as for example when withdrawing funds in advance for purchasing owner-occupied residential property.

How many vested benefits accounts can you have with frankly?

How many vested benefits accounts can you have with frankly?

You can open up to four different vested benefits accounts with frankly: two with the Vested Benefits Foundation and two with the Vested Benefits Foundation II. This can be particularly useful when you have vested benefits from different vested benefits events.

What happens with the vested benefits when I start a new job?

What happens with the vested benefits when I start a new job?

In this case, you must transfer your assets to your employer’s pension fund. The vested benefits account is then liquidated.

Is it also possible to make a staggered withdrawal from the Pillar 3a?

Is it also possible to make a staggered withdrawal from the Pillar 3a?

Yes, but you need to have multiple accounts to do this. This is because with the Pillar 3a as well you can only withdraw the entire balance from an account.

Who receives the vested benefits in case of death?

Who receives the vested benefits in case of death?

In case of death, the vested benefits are paid out to the legal beneficiaries. These are mostly the surviving spouse or the registered partner as well as children who are still minors or still in education. Other persons who are financially supported by the deceased may also have a claim: most often this is the person’s life partner in a cohabitation relationship. Beneficiary status can be changed within a very narrow framework.

How is the pension fund split in case of divorce?

How is the pension fund split in case of divorce?

In case of divorce, the pension fund benefits accrued during the marriage are divided equally between the spouses. This means that the pension fund assets accumulated during the marriage are generally divided equally between both spouses. However, there are some special cases, such as when one spouse is already receiving a pension or when funds have been withdrawn to finance the purchase of residential property. In any case, a final divorce decree under Swiss law is required for the pension fund to be split.

Other questions about pension fund splitting

Other questions about pension fund splitting

You can find more questions and answers regarding pension fund splitting in our FAQ.

Why frankly?

Simply cheap

Thanks to the low all-in fee of 0.43%, you'll have more for yourself.